Explore All Research and Insights

Filter

Featured

Sustainability Hour featuring Pirelli Tire North America

April 15, 2024

Environmental, Social, and Government (ESG) disclosure standards have been voluntary practice for years. Organizations like the Global Reporting Initiative (GRI) and Taskforce for Climate-related Financial Disclosures (TCFD) have...

Featured

2024 Talk From the Top

April 10, 2024

Returning as a favorite Vision Conference member-only session, ‘Talk from the Top,’ led by MEMA Aftermarket Suppliers president, Paul McCarthy, provided supplier members exclusive access to unfiltered customer CEOs’ views on...

Featured

The MEMA Commercial Vehicle Pulse Series

March 27, 2024

The MEMA Commercial Vehicle Pulse Series is a collection of member-only surveys, reports and webinars circulated as topical issues arise in the industry. Each report will begin with a short survey, taking no more than five minutes...

Featured

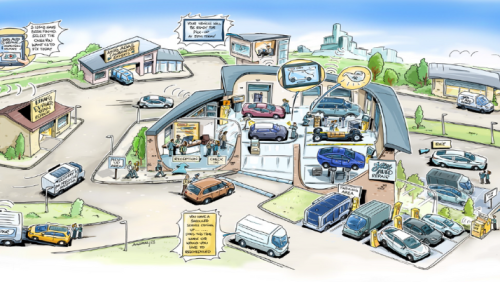

Shop of the Future

February 28, 2024

Three major changes in the automotive aftermarket will impact shops in the coming decade – shifting vehicle technology, consumer expectations and labor shortages. After talking with shops and suppliers, global consulting firm...

Featured

HD Talk From the Top

January 21, 2024

Download the first-ever Talk From the Top presentation about the commercial and heavy duty space. MEMA’s Senior Director Shannon O’Brien met with senior executives of your top aftermarket channel partner organizations to discuss...

MEMA & Evercore ISI Bi-Weekly Survey

April 11, 2024

MEMA Aftermarket Suppliers, in collaboration with well-known Wall Street analyst firm Evercore ISI, provides a bi-weekly snapshot of suppliers' orders from retailers and distributors. This report supplements the quarterly...

Washington, D.C. Update: EPA LD/MD Multipollutant Standards Final Rule

March 26, 2024

On March 20th, the U.S. Environmental Protection Agency (EPA) announced their final ruling on Light- and Medium- Duty Vehicle Emission Standards. The EPA ruling will set more protective standards to reduce pollutant emissions for...

MEMA Sustainability Hour featuring ArentFox Schiff

March 26, 2024

After nearly two years of intense discussion and debate, the SEC has issued its final rules on climate related financial disclosure. According to the SEC, “The final rules reflect the Commission’s efforts to respond to investors’...

Auto Parts Retail Growth Should Tick Higher in 2024

March 13, 2024

In this March 2024 webinar, Seth Basham of Wedbush Securities discussed the economic and market forces that translate into low single-digit growth in the aftermarket over the coming quarters in 2024. Download the presentation deck...

MEMA Sustainability Hour featuring S&P Global Mobility

January 29, 2024

Sustainability is a hot-button issue in the automotive and commercial vehicle industries. A major focus has been on the reduction of greenhouse gas (GHG) emissions, and battery electric vehicles (BEVs) are viewed as the endgame...